July 6, 2020 - (Brussels/Berlin) Today, the EU-funded CityChangerCargoBike project released key results of the first European Cargo Bike Industry Survey. These results are based on anonymised sales data provided by 38 cargo bike brands.

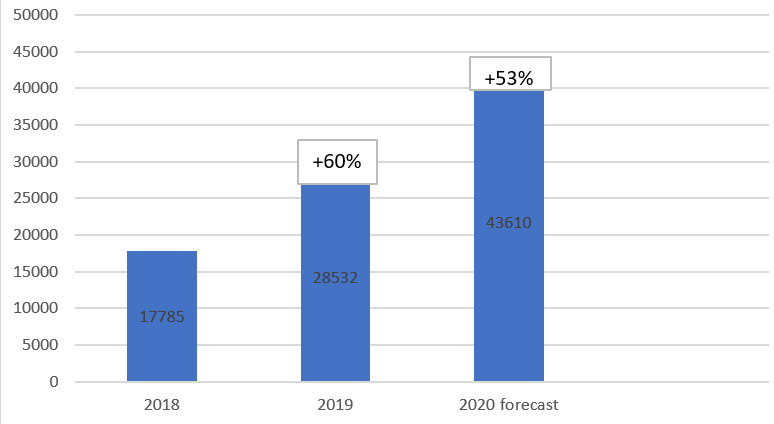

After selling 17,800 cargo bikes in 2018 and 28,500 in 2019 the 38 survey participants expect to sell 43,600 cargo bikes across Europe in 2020. While this anonymised sample of cargo bike brands cannot account for the total size of the European cargo bike market, it clearly indicates its trends and impressive growth.

In 2019, sales of survey participants grew by around 60 percent. And despite the timing of the survey during the Coronavirus lockdown in May, they expect an ongoing rapid increase of 53 percent for 2020.

Cargo bikes sales in Europe of 38 survey participants. © CityChangerCargoBike / www.cyclelogistics.eu/market-size

Seven of the 38 brands are newcomers with no sales in 2018. While in 2018 none of the 38 surveyed brands sold

more than 5,000 cargo bikes, three of them expect do so in 2020. This

shows the diversity and dynamism of the cargo bike industry with many

young and still small brands and an increasing number of bigger players.

The survey also asked each brand for the sales share of different cargo bike types and for their main national markets in Europe. Results:

Sales of cargo bikes for private and for commercial use are growing equally fast. Their market shares remain almost equal.

The majority of cargo bikes are sold with electric assist and their share of the market is growing. The share of cargo bikes without electric assist decreased from around 31 percent in 2018 to around 25 percent in 2019.

Sales of three wheeler cargo bikes are growing a little faster than two wheelers. Their share is almost equal in expected sales for 2020. Four wheeled cargo bikes are yet to play a significant role.

Germany is the most important national market in Europe for 16 of the 38 survey participants. Denmark (with a population 14 times smaller) was selected 4 times, UK and the Netherlands 3 times. But the European cargo bike market is not limited to only a few top markets. 17 countries are among the top three markets of at least one of the survey participants.

Kevin Mayne, CEO Cycling Industries Europe and partner of the CityChangerCargoBike project, commented:

We have identified for some time that the cargo and delivery bike market has really high potential for the cycling industries of Europe. This survey makes me very confident that we are on the right track, with the sector doing well and a diverse range of vehicles increasingly meeting all market needs across Europe.

Berlin based cargo bike expert Arne Behrensen, editor of cargobike.jetzt and co-ordinator of the survey, added:

50 – 60 percent annual market growth is in line with observations of CityChangerCargoBike partners who promote cargo bike use across Europe. But in many regions the cargo bike revolution is still in a very early stage. Decarbonizing transport, improving air quality and regaining public street space needs more political support for sustainable vehicles like cargo bikes.

A study by CityChangerCargoBike project leader FGM-AMOR already in 2013 showed a huge potential for cargo bikes and was quoted by the EU transport ministers‘ 2015 declaration on cycling: “more than half of all motorized cargo trips in EU cities could be shifted to bicycles”.

The European Cargo Bike Industry Survey will be repeated in spring 2021.

Background:

The CityChangerCargoBike (CCCB) project‘s mission is to fully exploit the huge potential of cargo bikes in Europe. It includes 16 partner cities

from Lisbon in Portugal to Gdynia in Poland. The project is supported

by the European Union‘s Horizon2020 programme from 2018 to 2021.

www.cyclelogistics.eu

The trade organisation Cycling Industries Europe (CIE) coordinates the European Cargo Bike Expert Group

as part of the CCCB project. The expert group is open to all companies,

institutions and experts with stakes in the cargo bike sector.

www.cyclingindustries.com

cargobike.jetzt is a Berlin-based consultancy and blog specialised in promoting cargo bikes. Editor Arne Behrensen coordinated the European Cargo Bike Industry Survey.

www.cargobike.jetzt